Cashflow 101, Part 1: The Importance of Payment Terms

In this series, we will take you through the complexities of cashflow; everyone is always talking about it, but what exactly does it mean for your business, and what are you actually supposed do about it?

Lack of cashflow isn’t just about not having money in the bank; it’s about the movement (or lack of movement) of cash running through your business.

Even small changes in your cashflow can have enormous ramifications for your business.

Cashflow is the movement of cash through your business;

Cash goes out to buy supplies and labour,

supplies and labour become products,

products get sold,

cash comes into your account from the sale of your products and goes back out again to buy more supplies and labour (and hopefully profit for you to keep)

So, let’s start at the very beginning and add more each week until you understand how crucial cashflow is.

Payment Terms

The first time you made out an invoice, you got to decide when you wanted to get paid by setting payment terms; very likely, you probably just copied someone else’s invoice template and it probably had one of the most common payment terms.

a) Payable upon receipt

b) 30-day terms

c) 60-day terms

And you probably just went along with whatever was suggested to you or what was dictated to you by your customer.

Very few people start out in business thinking about payment terms; they are just happy that they found someone who wants to pay them for their work.

But payment terms make a huge impact on cash-flow.

Let’s see how the different payment terms affect you. We will use a very simple example.

You have $150 in your bank account and decides to start a business making barrels

You buy supplies for $100 (this will enable you to build one barrel)

You hire your friend Sam and pay him $50 to help make the barrel

You now have zero dollars in your bank account, but no worries because you just sold your barrel to Barrels of Fun, and they told you to issue an invoice for $300 with 60-day terms.

You have no more money to make more barrels, and Sam is out of a job for 60 days until you gets paid, and so you wait.

60 days later, Barrels of Fun has paid you and you have $300 in your bank account. You decide that you will use all of your money to make 2 barrels, and so

You buy supplies for 2 barrels $200

You pay Sam to help you make 2 barrels $100

Again, you now have zero dollars in your bank account, but since Barrels of Fun loves your barrels, and they will buy both. You can invoice them, and they will happily pay you in 60 days.

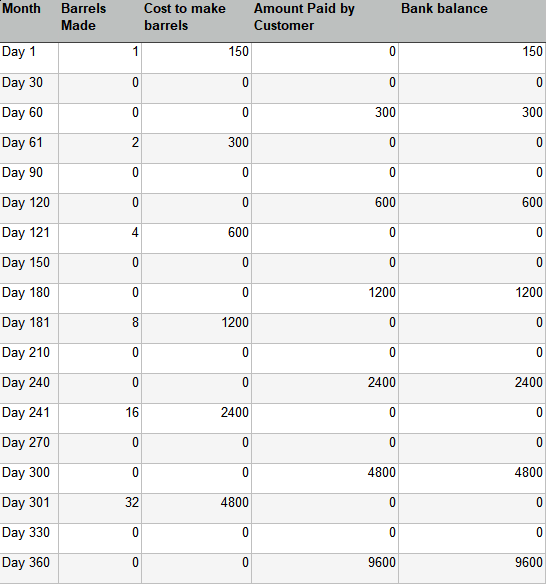

Let’s play out the 60-day payment term scenario until the end of the year. Now, of course, this is just supplies and paying for Sam, non of those other pesky expenses like taxes, electricity, or paying yourself.

So great news, your business is profitable; you managed to turn $150 into $9,600 in 1 year.

You had long stretches where you had no work, and you were only able to work six months out of the year. The rest of the time, you were waiting to get paid. I hope Sam, your employee, had other work elsewhere in those months.

You were able to double your sales every 60 days; the only thing holding you back from making more money was how long it took to get paid.

So what would it have looked like if your payment terms were 30 days? Would you have been able to make twice as much, if you got paid in half the time? Let’s take a look.

Wait a minute? How did that happen? It didn’t just double!

That’s the magic of cash-flow! If you get paid sooner, you can work more, and if you work more, you can earn more.

Well, you may say, no one can just double their output every month forever, you would need employees and more room and better shipping, etc., and yes that is all true ( we will come to these cashflow issues later).

I am trying to illustrate that getting paid faster is a tool for making money; the faster money flows, the more you get paid.

So lesson 1 is not about the amazingness of math; that’s just a given, it’s about the difference between thinking you know something and actually knowing something. In the case of today’s lesson, the takeaway is that payment terms are a big deal.

Here’s a quiz to make sure you got what we were talking about

Who decided on your payments terms

a) I did and I was very thoughtful about what my payments terms should be

b) I used what was suggested to me by some other business owner

c) My payment terms are dictated by my customer

d) I don’t know what my payment terms are

e) I don’t include payment terms on my invoices, my customer will pay when they are ready to pay

Payment terms are negotiable?

a) yes

b) no

c) sometimes

Using our barrel making example, you turning $150 into $9,600 was

a) great work, you’re a great business person, are you single? Asking for a friend.

b) pretty darn good for a part-time job, you are pretty lucky to have a friend like Sam who doesn’t need consistent work

c) leaving a lot of money and potential on the table, if you could have decreased you payment terms to 30 days, you could have made 32X the money and sold 2048 chairs instead of 32.

Circle any answers that have to do with cashflow, as you understand it from this lesson

a) cashflow is the movement of cash, money buys supplies and labour, supplies and labour become products, products get sold, money comes into your account to buys more supplies and labour (and hopefully profit for you to keep)

b) Consistent cashflow results in steady and consistent work

c) Cashflow means money is flowing into your account frequently, meaning you have cash to pay your bills, employees and yourself

d) As a business owner you can decide what your payments terms are ( your customer may not agree to them but you can ask)

e) Each day that you can get paid faster means better cashflow for your business.

f) All things being equal, getting paid faster means making more profit by the end of the year