Cashflow 101, Part 2: The Importance of Pricing

Last lesson we learned the impact of payment terms on your ability to earn and to grow your business, today we are going to learn about the importance of incremental price adjustments on your bottom line and cashflow.

Most business owners aren’t sure what their prices should be when they start, normally they will look at what a competitor is doing and set their price at the same or lower price. This makes sense when you are setting out because even if you’ve done cost projections, it’s difficult to know all of your costs until you’ve been in business for a while. Additionally, when your company is new, being cheaper will often get you a contract that you may have not otherwise won.

Once you have your foot in the door and know what your product or service costs you to deliver then increasing your prices will obviously lead to more profit, but do you actually know how much more? Let’s take a look together.

In the last lesson we looked at how changing your payment terms from 60 to 30 days impacted your profit and productivity in your fictional barrel bustling business and today I want to convince you that you should be getting paid more for your hard work, so we’ll explore raising the price of your barrels by 5%.

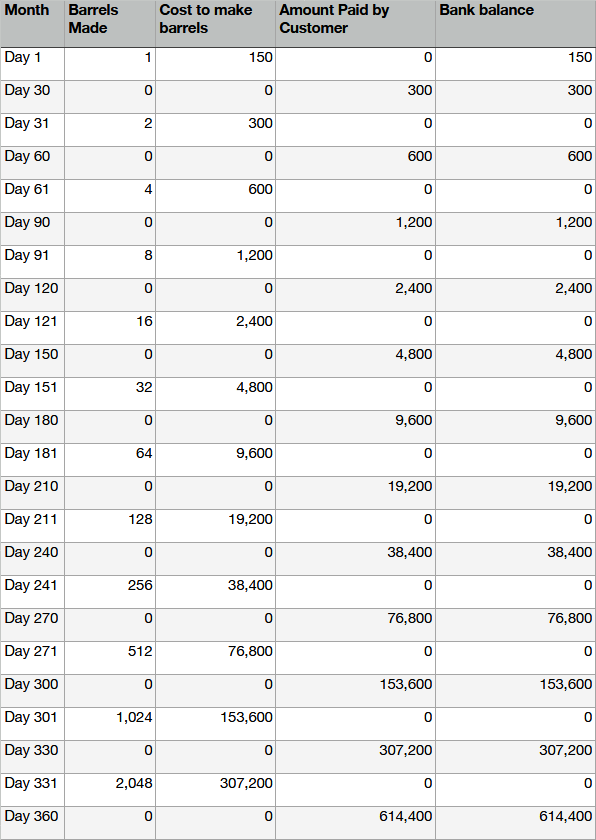

Below are your original earning with 30 day terms:

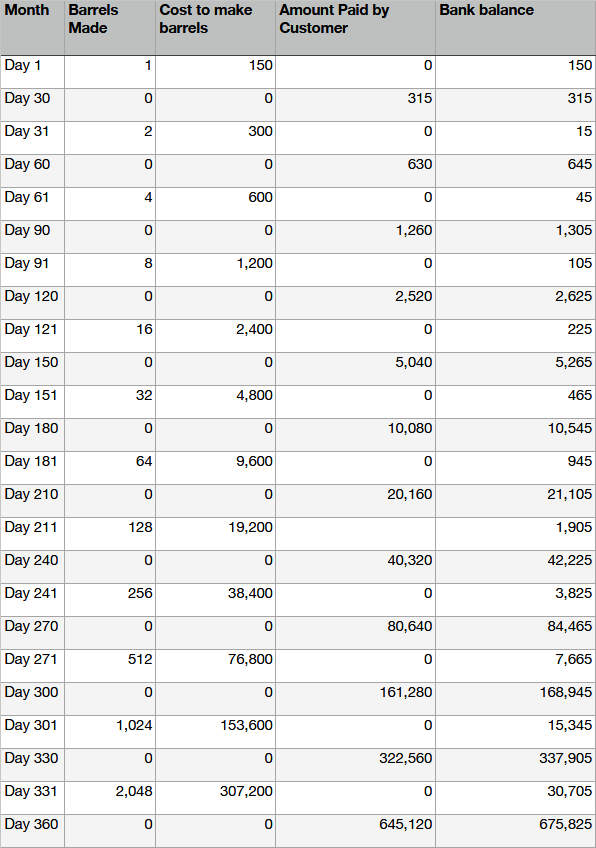

And here are your earnings with 30 day terms and a 5% price increase:

You have now earned an extra $61,425.00. Sam (your fictional employee) is not the only one getting paid now, you’re making coin too!

All of the money from the price increase not only goes to the bottom line, but it also protects you because you can always lower your prices should your suppliers press you on your pricing. But if you were already at your price bottom, the only way to accept a job at a lower price is to take the money out of your own pocket.

Lowering your price in the hopes of getting more volume.

You may argue that asking a lower price for your work will attract more sales, maybe so but can I ask you to consider this….

Would you really go to a burger place you didn’t like, with crappy service because their burgers were $9.49 instead of your favourite burger place where the service was also great, for $9.99. I hope you wouldn’t.

The customers that always take the lowest price or bid, no matter what, are usually terrible people to work with and they will keep grinding you on price even after the bid has been agreed on, this is just their way of doing business.

I want to warn you that a 5% difference in price is the difference between a “great” business and a “going out of business but doesn’t know it yet” business.

Let’s explore the dangers of lowering your price, or what I like to refer to as “the race to the bottom.” Even when it happened accidentally ( like your sales person always seems to shave just a bit off the price)

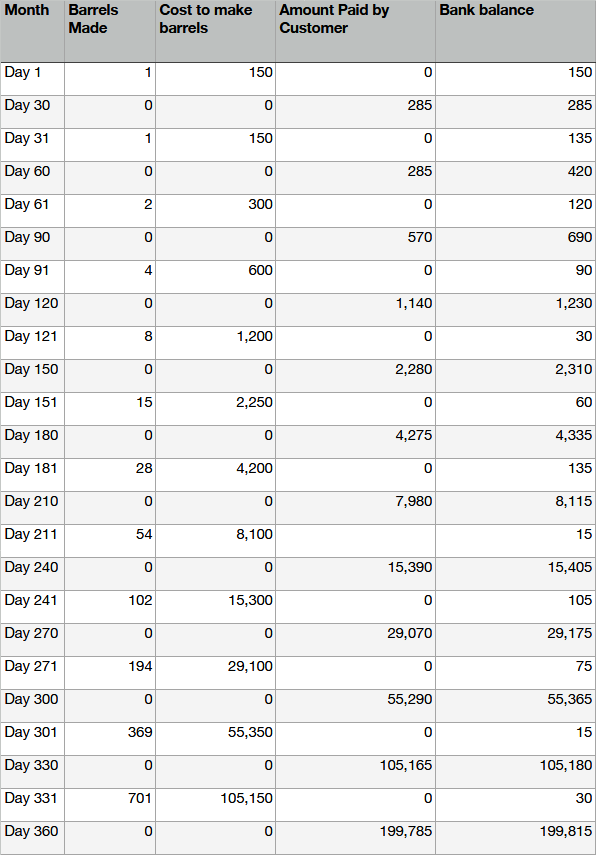

What is the effect of a 5% price drop to your bottom line (the money that goes into your pocket)? Let’s see…

A couple of things happened here

Reducing your price by 5% meant you couldn’t double your production of barrels until day 60, whereas previously your were able to double on day 30.

Reducing your price by 5% meant that on Day 151 you stopped being able to double production and had to reduce the production by 2 barrels, then the slow down just kept multiplying. 30 days later you, once again, couldn’t double your production and had to reduce it by another 6 barrels. A month later you had to reduce it by 10, then by 19 and finally by 37.

Originally, you had ended the year with 2048 barrels produced. Once you reduced your prices by just 5%, your total production for the year went down to 701 barrels, you finished the year with only $199,815 in the bank and you weren’t able to pay yourself anything for the trouble.

Increasing your price by 5% meant you could double your production at 30 days and you had an extra $15 to pay yourself, whereas before you had only been able to pay for supplies and for Sam’s labour. 5% increase - Not only was Bob able to double his production each month, and finish the year with $675,825 in his bank at the end of the year and he was able to pay himself $61,425.00.

So the lesson is, if you can, raise your prices, but if you feel you can’t, under no circumstances should you ever ever ever lower them. Let some other sucker do that and you can pick up the business when they go out of business.

Quiz time

Raising your price when you’ve proven that you can do good work is

The best way to become profitable

The right thing to do for your business and your bank account

Acceptable

Gives you the flexibility to lower the price on occasion

All of the above

Lowering your price to try to make it up in volume is

A wonderful way to go out of business

A foul’s errand

“A wonderful endeavour and I hope he starts lowering his prices right away.” quote from your biggest competitor.

The best way to attract poor quality customers

All of the above